The most anticipated event in the cryptocurrency community has finally occurred as the Bitcoin network just produced block number 630,000.

The Bitcoin halving will reduce the daily supply, the inflation rate, and the block rewards for miners. It has also raised serious discussions around the price of BTC.

2020 Halving Completed

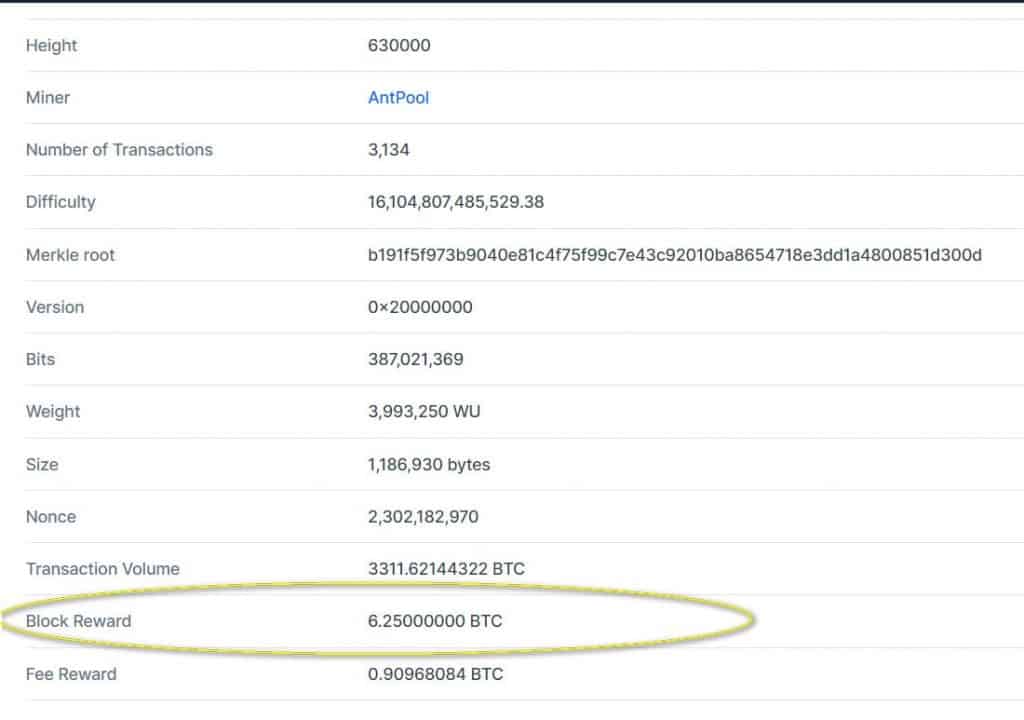

After months of increased discussions and speculation, the third-ever Bitcoin halving just took place at block number 630,000.

Naturally, it brings a significant amount of pre-programmed changes, which will have substantial effects on all parties involved, including miners, traders, and investors.

For the next approximately four years, or until the next batch of 210,000 blocks is produced, miners will be receiving 6.25 BTC per block instead of 12.5 BTC. Indeed, block 630,000 already has the new reward of 6.25 BTC.

As their rewards are cut in half, this begs the question if mining will still be profitable. One recent study indicated that Bitcoin’s price has to increase to about $15,000 or higher to be financially beneficial for miners.

With estimation based on ten minutes of average processing time per block, the number of freshly minted bitcoins is also reduced by half – from 1,800 BTC per day to 900 BTC.

The decreased daily supply also means that the inflation rate should go from about 3.72% before the 2020 halving to 1.8% now.

Bitcoin Hashrate

Since BTC miners, the backbone of the network, will now receive half of the rewards they used to, it’s worth examining the potential consequences on the hashrate. As CryptoPotato reported earlier today, the hashrate had registered a large spike in the hours before the event.

Now, minutes after the 2020 halving, the hashrate is a bit above 120 million TH/s.

Although miners receive less BTC after each halving, a recent report indicated that between 2016 and 2020, Bitcoin’s hashrate had skyrocketed by over 6800%. Despite the growing fears of some that miners might capitulate, they had been consistently putting more computational power to maintain the network.

BTC Price Effects

And while the above fundamentals are vital to the network’s health, the majority of the community is captivated by the potential effects on the price.

In the days and hours before the 2020 halving, Bitcoin marked serious levels of volatility.

Firstly, the price made a nice run and tested the psychological barrier at $10,000. Then it plunged to about $8,000 in hours, surged back up to $9,200, and retraced to $8,850. Now, after the halving, BTC is trading at around $8,550.

On a longer-term perspective, the halving has served as a significant catalyst for massive Bitcoin price increases in the past. In the months following the first halving in 2012, the asset skyrocketed from $12 to nearly $1,200.

The primary cryptocurrency was trading at about $660 on July 9th, 2016 – the date of the second halving. A year later, Bitcoin jumped to $2,800 and, in December 2017, reached its all-time high level at $20,000.

As such, it remains interesting to see if history will repeat itself after today’s events.