Most people think success goes in a straight line. But investing and especially trading is never like that.

My journey to discovering what stocks to buy — and hold for days, weeks or months — has taken me in circles for more than 10 years now.

You take two steps forward and one step back. We’re all emotional creatures and the desire to beat the market and to acquire immediate riches is very appealing.

I made my first money buying stocks in the crisis of 2008.

I bought Alcoa, Apple, Crox and some other names that were trading at a heavily discounted price. In just a few months, I was up 60%.

Now, I sold too early thinking another crash was around the corner. So I dabbled in trading futures.

I made and lost a small fortune trading the Gold Bubble of 2010. Then I lost a bunch of money trading Gold after the crash

Having discovered the leverage allowed by futures, I now dabbled into options. Lost another staggering amount of money trading options.

Then day trading — lost some money there too.

I followed every guru that was loud and confident and had the next stock pick. If I had $1 for every Guru I followed I could buy a car.

Most of them never made me any money.

But through a lot of trial and error, I also stumbled across things that worked. Stocks that I picked and held and resulted in big winners that could take me to the promised land.

Like the overnight acquisition of ESIO in 2018 which gave me a 100% gain.

In fact, 2018 was the year when I really turned the corner so to say and started picking the right stocks to buy.

Like Lockheed Martin LMT which I acquired a bit below $270 and is trading above $370 after having collected $6.6 dividends a share.

Or Bed Bath and Beyond which at $8 — it trades above $13 now.

And yes, I was long BIIB before earnings. The stock gapped up 35% overnight and my options exploded in value. I made another 200% gain on that in 2019.

So what was it?

Well, after a lot of trial and error and reviewing my trading journal and accounts… I noticed something interesting.

It’s not that I didn’t make money trading chart patterns, or momentum stocks. But I was also losing a lot and giving it back.

And yes, I made money on TSLA or BYND… but my most consistent winners have been simple, solid businesses that were not very glamorous and traded at a decent price.

Often times, the market tends to ignore these businesses in favor of hot Facebook or Amazon stock.

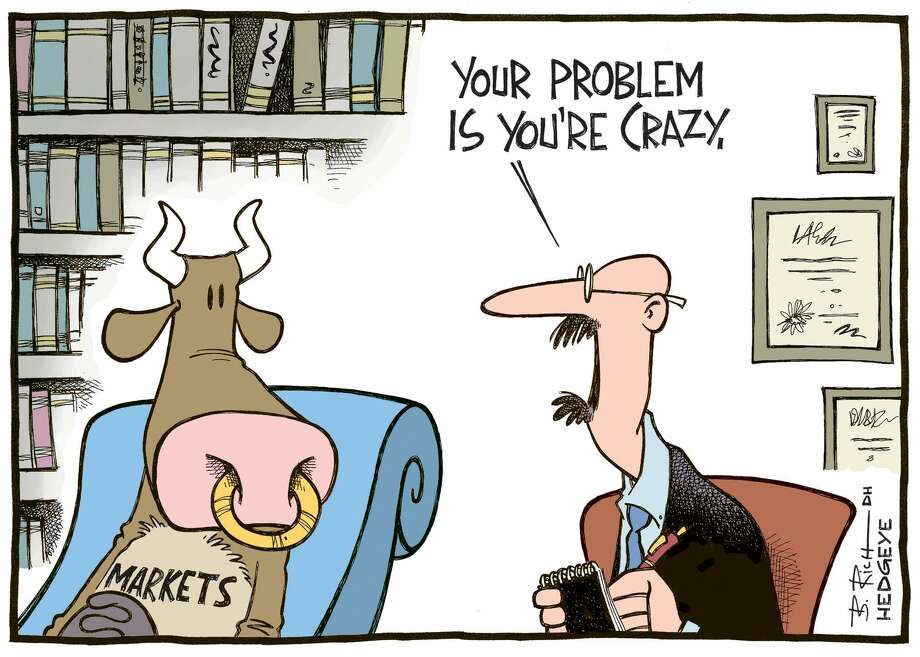

But eventually, everything that’s trendy and happening becomes too crowded to produce meaningful returns… And reverts to the mean.

And the market starts looking for value. For real businesses that are growing their earnings and turning a profit at a reasonable price.

This strategy was bread and butter.

And guess what, it’s one of Warren Buffet’s favorites too.

You see, Warren doesn’t like to talk about patterns, breakouts or trading psychology… because he knows all of that stuff although it sounds nice, it’s complicated and can fail like everything else…

Nobody needs to trade VIX futures. Yet, I often did and many times with disastrous results.

That’s when you realize that after meandering around for years, you come back to some simple principles.

There’s beauty in value investing – plus, simplicity. Boring and profitable is the new matra.

Instead of gazing at the colored lights of the casino, I wish I would have stuck to it for the past 10 years with a large percentage of my portfolio instead of chasing futures, options and day-trading.

But hey, at least I learned a lot… including how to do my own research, run my own watchlists, own my trades and have confidence in my methodology.

We learn from failure. It’s not the bigger or brightest that succeed. But the most adaptable. That’s Darwinism right there.

Feed the winners. Starve the losers

So stay tuned for some more takeaways from this amazing journey – and why not, some actual trades.

~ Ben